Despite hope for strong economic recovery, February sees further decline in national construction starts

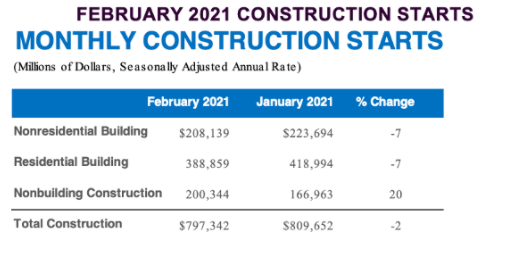

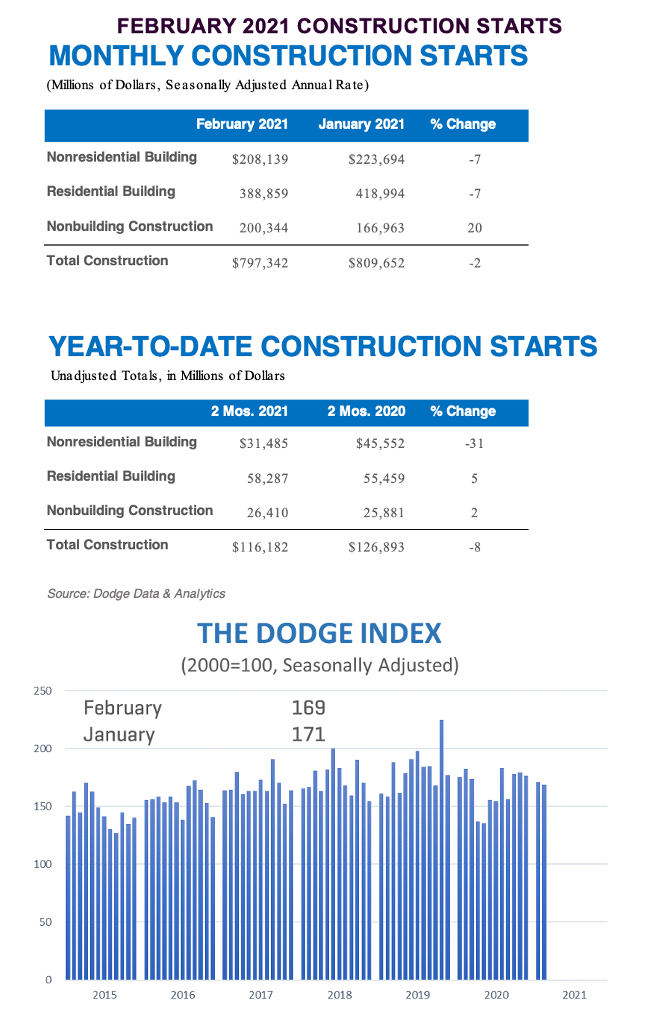

Total construction starts fell 2% in February to a seasonally adjusted annual rate of $797.3 billion. Nonbuilding construction starts posted a solid gain after rebounding from a weak January, however, residential and nonresidential building starts declined, leading to a pullback in overall activity. The Dodge Index fell 2% in February, to 169 (2000=100) from January’s 171.

“With spring just around the corner, hope is building for a strong economic recovery fueled by the growing number of vaccinated Americans,“ said Richard Branch, Chief Economist for Dodge Data & Analytics. “But the construction sector will be hard-pressed to take advantage of this resurgence as rapidly escalating materials prices and a supply overhang across many building sectors weighs on starts through the first half of the year.”

Below is the full breakdown across nonbuilding, nonresidential, and residential construction:

- Nonbuilding construction starts gained a robust 20% in February to a seasonally adjusted annual rate of $200.3 billion. The miscellaneous nonbuilding sector (largely pipelines and site work) surged 76%, while environmental public works increased 26%, and highway and bridge starts moved 11% higher. By contrast, utility/gas plant starts lost 17% in February.

For the 12 months ending February 2021, total nonbuilding starts were 13% lower than the 12 months ending February 2020. Highway and bridge starts were 4% higher on a 12-month rolling sum basis, while environmental public works were up 1%. Miscellaneous nonbuilding fell 26% and utility/gas plant starts were down 37% for the 12 months ending February 2021.

The largest nonbuilding projects to break ground in February were the $2.1 billion Line 3 Replacement Program (a 337-mile pipeline in Minnesota), the $1.2 billion Red River Water Supply Project in North Dakota, and the $950 million New England Clean Energy Connect Power Line in Maine.

- Nonresidential building starts fell 7% in February to a seasonally adjusted annual rate of $208.1 billion. Institutional starts dropped 8% during the month despite a strong pickup in healthcare. Warehouse starts fell back during the month following a robust January, offsetting gains in office and hotel starts, and dragging down the overall commercial sector by 8%.

For the 12 months ending February 2021, nonresidential building starts dropped 28% compared to the 12 months ending February 2020. Commercial starts declined 30%, institutional starts were down 19%, and manufacturing starts slid 58% in the 12 months ending February 2021.

The largest nonresidential building projects to break ground in February were Ohio State University’s $1.2 billion Wexner Inpatient Hospital Tower in Columbus, Ohio,, ApiJect Systems’ $785 million Gigafactory in Durham, North Carolina, and Sterling EdgeCore’s $450 million data center in Sterling, Virginia.

- Residential building starts slipped 7% in February to a seasonally adjusted annual rate of $388.9 billion. Both single-family and multifamily starts fell during the month, with each losing 7%.

For the 12 months ending February 2021, total residential starts were 4% higher than the 12 months ending February 2020. Single-family starts gained 12%, while multifamily starts were down 15% on a 12-month sum basis.

The largest multifamily structures to break ground in February were Bronx Point’s $349 million mixed-use development in The Bronx, New York, the $215 million Broadway Block mixed-use building in Long Beach, California, and the $200 million GoBroome mixed-use building in New York.

· Regionally, February’s starts fell lower in the South Central and West regions but moved higher in the Midwest, Northeast, and South Atlantic Regions.